I continue to see lots of confusion and misinformation about inflation. It’s tempting to jump straight into debates about what causes it, who is to blame, and what we can do about it. But too many of us enter those debates without first understanding the basics.

That’s not entirely our fault. For decades, there has been a deliberate effort to redefine terms, conflate cause and effect, and promote economic theories that don’t hold up. In short, the people responsible for inflation don’t want you to understand it. So they intentionally use vague language, cite discredited theories, and redirect your anger toward anyone except themselves.

What Inflation Actually Is

By classic definition, inflation simply is an increase in the money supply. That’s it. When the money supply is “inflated” — through printing or its modern digital equivalents — inflation has been created.

In the common vernacular today, most people use the word “inflation” to mean rising consumer prices, or maybe producer prices, often citing government-issued statistics such as the Consumer Price Index (CPI), or the Producer Price Index (PPI). But that’s not just sloppy language — it’s part of an intentional shift of focus away from the cause (inflating the money supply) to the effect (higher prices).

Why Definitions Matter

Keynesian economics, now the dominant economic school of thought in most governments (and thus most universities and the media), has fully embraced this redefinition. When I studied economics in college, the curriculum presented Keynesianism as the only valid approach. In fact, my professors and my text books completely failed even to acknowledge the existence of other economic schools like Austrian or Chicago. It took years of self-study to unlearn much of what I was taught.

The reason Keynesian ideas persist isn’t because they’re correct, but because they align with the interests of politicians. Politicians benefit from inflation — and from the confusion around it.

Cause vs. Effect

Let’s be clear:

- Inflation is the increase in the money supply.

- Higher prices are the effect of that inflation.

Prices don’t rise because of corporate greed, labor unions, or other convenient scapegoats. And despite ridiculous claims to the contrary, rising prices is not some natural phenomenon (quite the opposite, in fact). Across the global economy, prices routinely increase for only one reason: the money supply has been inflated faster than productivity improvements can reduce costs.

If the money supply were fixed, prices for most goods would naturally decrease slowly over time, thanks to technology and productivity and efficiency gains. High-tech products like TVs demonstrate this vividly. Even today, despite inflation, you can buy a much better TV for a much lower price than you could just a few years ago. The productivity gains in the consumer electronics space more than offset the impact of the inflation. (Just imagine how inexpensive TVs would be without inflation!)

Meanwhile, the price of things like haircuts generally rise in line with inflation because the process hasn’t fundamentally changed over the years. On balance, without monetary inflation, average consumer costs might fall 2–3 % annually.

From Gold to Fiat

For some 5000 years, humans naturally converged on gold as a monetary standard. Under a gold standard, inflation was limited by the natural scarcity of gold (1.5–2.5 % annual growth in the gold supply). Prices remained stable for decades.

But over the 20th century, governments gradually dismantled hard money systems. Just looking at the U.S.:

- 1913: The Federal Reserve Act centralized control.

- 1933: FDR confiscated Americans’ private gold holdings under Executive Order 6102. (You knew this, right?!)

- 1971: Nixon “temporarily” closed the gold window (this “temporary” measure remaining in place until today), causing the U.S. to default on its promises under Bretton Woods, and fully severing money from gold.

Since then, fiat money has become the standard globally, and the consequences are visible everywhere (see: WTF Happened in 1971?).

Why Governments Inflate

Fiat systems are irresistible to politicians. Fiat allows the politicians to promise lots of “free” programs and hand out stimulus checks far beyond tax revenues, without openly raising taxes. Instead, deficits grow, the debt grows even more, and central banks cover the gap by printing money. It’s a great trick. Until it isn’t.

That printing is inflation — and it necessarily drives consumer prices higher. The lag may be months, but the math is straightforward: if prices would have naturally fallen by 3 %, but the money supply grows by 7 %, the result will be a 4 % rise in consumer prices.

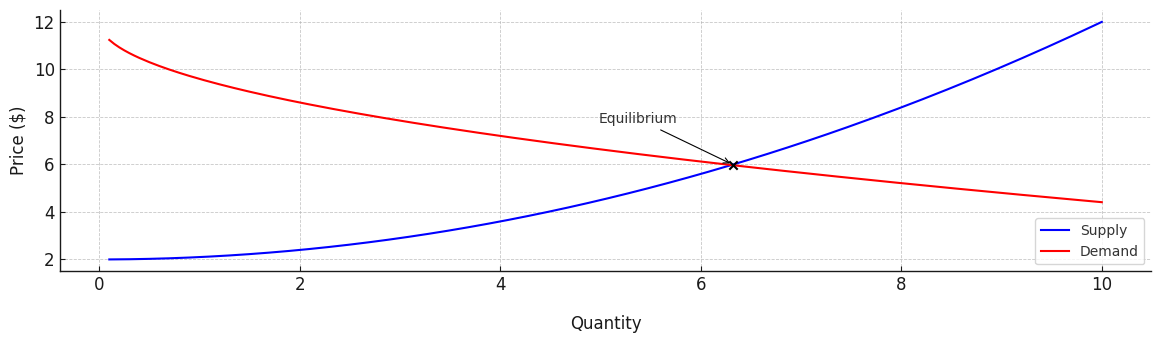

The math is truly that simple. And inevitable. Inflation of the money supply redraws the supply and demand curves on the classic graph used by all economists. The equilibrium point where the two curves intersect (i.e., the market price) is going to move higher.

I’m sure some of you are tempted here to blame that one political party you dislike, or some specific administration. But for decades, this has been a consistent, nearly universal, theme across most of the world’s governments, regardless of party or ideology or which specific administration is in power.

The Hidden Tax

Inflation acts as a regressive, hidden tax. Everyone pays, but the wealthy — who understand what’s happening and often benefit first through the Cantillon Effect— come out way ahead. The poor and middle class bear the brunt. Yes, in an inflationary environment, the rich get richer. And the poor . . . well, you know what happens to them.

This is why politicians love inflation. It funds the programs that get them votes without requiring them to authorize an explicit tax increase, which would lose them votes. Meanwhile, complicit Keynesian economists in the government, academia and among the media and social “influencer” community provide cover.

What Can We Do?

If you’ve read this far, thank you! Now you can see the situation for what it is. So, what do we do about it?

The fiat money experiment has failed. To protect ourselves, society must shift back to hard money. That doesn’t mean riots or revolutions — it means everyday choices:

- Store your wealth in hard money instead of fiat.

- When possible, earn income in hard money.

- If you’re paid in fiat, convert it quickly to hard money.

If enough people do just these simple things, fiat will wither, and inflation will naturally correct itself. Governments will have to start using hard money again. They will no longer have the power to spend recklessly; they’ll be forced to live within their means, and use debt responsibly, just like households and businesses.

Yes, the transition will be messy and probably painful for many who don’t understand and don’t see this coming. But at this point, I believe it’s inevitable. Game theory tells us as much.

In the end, it will all be worth it. A hard money system reduces inequality, curbs government overreach, and restores long-term stability to society. It will allow normal people simply to save what they earn without feeling the pressure to also be a smart enough investor to find returns that overcome the effects of inflation. Over time, the buying power of their hard money savings will naturally grow instead of melt away.

My advice? Seriously consider front-running this global transition. From studying history, there is good reason to believe the change will be one of those “gradually, then suddenly” events. When we get to the “suddenly” point, it might be too late to get in front of the change. I am not in the business of giving investment advice, but I do suggest you do your own homework and consider whether moving at least a small percentage of your fiat into hard money makes sense. Whatever you do, make sure you’re not the last one holding a worthless bag of fiat.